Introduction to Indian Money Market

The Indian money market is an integral part of the financial market that primarily deals with the short term borrowing and lending of funds. The other components of the financial market are capital market, government securities market, and foreign exchange market. The Indian money market plays a pivotal role in ensuring efficient allocation of funds, providing liquidity to participants and facilitating economic growth.

The primary function of the Indian money market is to ensure efficient fund allocation and provide liquidity to participants, contributing to the smooth functioning of the economy. The Indian money market serves as a platform for liquidity management and price discovery.

Historical Overview Of Indian Money Market

The Indian money market started evolving during the British rule which started modern banking in India. It all started with the establishment of the Presidency Banks and the enactment of the Paper currency Act. The Reserve Bank of India (RBI) was established in 1935 which was solely responsible for regulating monetary policies and controlling the money supply in the country.

What Is Money Market ?

Broadly speaking, the Money Market is a market that deals with financial instruments that have high liquidity and short term maturities. The maturity period of these instruments is less than 1 year. The Indian money market deals with Treasury Bills, Commercial Papers and Certificates of Deposits. Companies and banks issue Commercial Paper and Certificates of Deposits respectively to raise short term funds. Relatively, the money market is a safe place to invest because of its high liquidity even though the returns are less compared to capital markets. Withdrawing money is relatively easy from the Money market.

[Read Also: Indian Capital Market]

Structure Money Market / Money Market Instruments

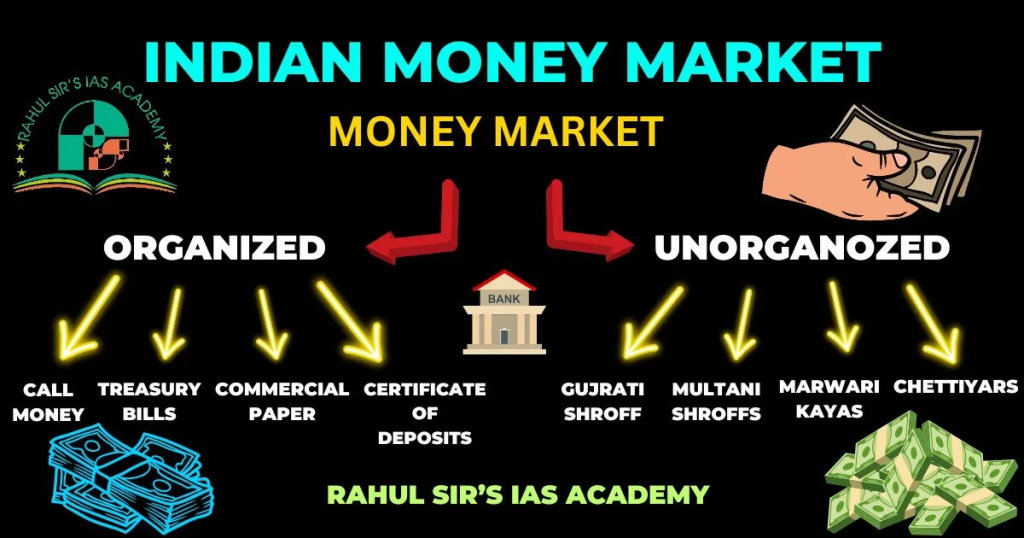

There are 2 broad categorizations of the Indian money market : the Organized and Unorganized money markets. In this article on Money Market we shall discuss these instruments in a precise manner.

Features Of Money Market / Money market Instruments

A. Organized Money Market:

i. Call Money Market

It is also known as the ‘Notice Money Market’ or ‘Interbank Market’. This is a market of very short term funds usually 1 day or a fortnight. It facilitates the banks to perform overnight borrowing and lending of funds in case of shortages or surpluses respectively. It is a very important part of the Indian money market as it keeps the liquidity intact. Organized money market has the following features:

- The rate at which the funds are lent or borrowed is called the ‘Call Money Rate’.

- The Reserve Bank of India keeps a keen watch on these rates as they give insights into the liquidity situation in the economy.

- If the Call money rates are high, this means that the markets are tight. If the Call Money rates are low, it means that the market is easy.

- Another feature of the Call Money market of the Indian Money Market is that no security or collateral is required to cover transactions.

- It does not require the intermediation of brokers thus it is an Over The Counter Market.

ii. Treasury Bills Market:

In the Indian money market the Treasury bills are those money market instruments that are issued by the Government of India. They are promissory notes that give a guaranteed repayment at a later date. The Reserve Bank of India issues these bills to raise funds for short term requirements in order to meet the obligations that are in excess of annual revenue generation. This is done primarily to reduce the fiscal deficit and to regulate the total currency in circulation at any given point of time. Some other salient features related to Treasury bills in the Indian money market are:

Features

- They are issued in the form of 14, 91, 182 and 364 days maturity periods.

- Treasury Bills are auctioned every week by RBI through non competitive bidding thereby allowing small and retail investors to participate in this through Primary Dealers.

- They are issued at a discount on the face value of the security and are redeemed at the nominal value on maturity allowing investors to pocket the difference as profits. E.g. if the face value of a particular T-Bill is Rs 120, then it will be issued at say Rs 118.4. On maturity the investor would redeem these bills at the nominal value of Rs 120 thereby pocketing a profit of Rs 1.6.

- The RBI issues these T-Bills through the Open Market Operation in order to regulate the money supply and the spending/borrowing habits of individuals. For instance during high inflation phases, high valued T-Bills are issued to reduce the aggregate money supply in the economy thereby reducing inflation. Similarly low valued treasury bills are issued during recessionary phases.

- The major advantages of T-Bills are : Risk free investments, Highly liquid, Non competitive bidding.

- Disadvantages of T-Bills are: Low returns and Subject to Short Term Capital Gains Tax.

- Auctions of Government Securities (G-Sec) which include Treasury Bills (T-Bills) and Dated Securities (Capital Market Instrument) are conducted through an electronic platform called E-Kuber.

- Major Participants of Treasury Bills (along with other Government Securities) are : Commercial Banks, Scheduled UCB, Insurance Companies, Provident Funds and Primary Dealers. All of them have to maintain a Funds Account (Current Account) and a Subsidiary General License (SGL) account with the RBI.

iii. Commercial Paper (CP) Market:

Commercial Paper was first introduced in India in 1990 to enable financial institutions and large corporations to diversify their sources of short term borrowings and to provide an additional instrument to investors. In the Indian money Market, Commercial Paper is an unsecured money market instrument issued in the form of promissory note. Initially only corporates were allowed to issue Commercial paper, but over the period Primary dealers and Financial Institutions were also allowed. Some salient features of Commercial Papers are:

- Their maturity period ranges from 2 days to 270 days. The average maturity is 15 to 45 days.

- They are not backed by any collateral. Therefore only those companies that have an excellent credit rating are allowed to issue Commercial Paper.

- Like Treasury Bills, Commercial Papers are also issued at a discount price to the face value.

- The firms issuing Commercial papers must obtain ratings from CRISIL, ICRA, CARE, FITCH or any other credit rating agency (CRA) that may be specified by RBI. As per SEBI norms, the minimum rating should be A-2.

- They are issued in multiples of Rs 5 lakhs.

- The amount of money to be raised through Commercial Papers must be within the limits suggested by the rating agencies and it must also be approved by the Board of Directors.

iv. Certificate of Deposit (CD) Market:

Introduced in 1989, Certificate of Deposit is one of the major components of the Indian Money Market. CoDs aim at providing greater flexibility to investors for utilization of short term funds. Thus they are fixed return investments governed by RBI rules and are issued in Dematerialized form. Some other salient features of CDs in Indian money market are:

- They can be issued by Scheduled Commercial Banks and some select financial institutions.

- Individuals, companies, corporations and funds can invest in Certificate of Deposits.

- No loans can be provided by financial institutions against CDs.

- Banks cannot buy their own CDs before their maturity.

- They are issued for a minimum deposit of Rs 1 Lakh and in its multiples.

- They are almost the same as Fixed Deposits. The only difference is that while Fixed deposits are done with banks, CDs can be issued by banks as well as financial institutions.

- Banks can issue CDs for maturity ranging from 7 days to 1 year. Financial institutions can issue CDs for maturity ranging from 1 year to 3 years.

- There is no lock in period for them.

v. Collateralized Borrowing and Lending Obligations (CBLOs):

In the Indian money market CBLO is an instrument through which financial institutions can raise funds for the short term by pledging prescribed securities as collateral. This segment of the money market is operated by the Clearing Corporation Of India (CCIL).

- CBLOs are similar to Call Money Market, the only difference is that in Call money market there is no collateral involved.

- Usually those entities participate in the CBLO market who have limited or no access to the Call Money market.

- Scheduled Commercial Banks, Foreign Banks, Co-operative banks, Insurance Companies, NBFCs, Provident/Pension funds can also participate in CBLO market.

[Read Also: Anti Defection Law Article]

B. Unorganized Money Market:

Unorganized money market has existed in India since ancient times. We cannot call it an integral part of the Indian money market, yet it plays a significant role in rural areas and business hubs in urban areas. This market persists because there are limitations to the organized money market to penetrate the rural areas. Also the unorganized money market provides instant cash to its borrowers even though the interest rates are quite exorbitant. The unorganized money market can be divided into 3 categories:

- Unregulated Non Banking Financial Intermediaries : These operate in the form of Chit Funds, Nidhis and loan companies. Most of them operate in limited circles and charge exorbitant interest rates ranging from 36 to 48 percent per annum. Thus in a way they are exploitative in nature.

- Indigenous Bankers: They accept deposits and lend money. They operate in individual capacities or firms. These include Gujarati Shroffs, Multani or Shikarpuri Shroffs, Marwari Kayas, Chettiars.

- Money Lenders: They operate in the most localized way and this is the most exploitative segment of the Indian money market.

- Operations of the Indian Money Market

The Indian money market operates through various instruments and mechanisms that facilitate short-term liquidity management and financial transactions.

A. Repo and Reverse Repo Market:

When banks and financial institutions are short of funds, they borrow from the RBI by selling securities like treasury bills or government bonds. ‘Repo’ means repurchase option or repurchase agreement. Commercial banks and financial institutions borrow money from the RBI which is repaid according to the repo rate applicable. ‘Reverse Repo’ is the opposite of Repo, in which the RBI borrows money from banks and financial institutions by selling securities

B. Open Market Operations (OMO):

The Reserve Bank of India regulates the money supply in the economy by selling and buying of securities which are in the form of Treasury Bills or Government Bonds. This buying and selling is done in the open market through auctions every week on a specified date and time. This is also a mechanism of controlling inflation as excess liquidity is sucked by means of these open market operations. Thus this is an important instrument of the Indian money market.

C. Regulation:

The RBI acts as the regulatory authority for the Indian money market by keeping a close watch on its functioning in order to ensure stability. For this it formulates monetary policies, sets interest rates, and implements measures to control inflation and promote economic growth.

[Read Also: Women Empowerment In India]

Importance Of Money Market / Indian Money Market

A. Liquidity Management:

All entities require funds to run their operations. In this regard the Indian money market plays a vital role. It addresses the short-term liquidity needs for banks, corporates, and the government. Thus the Indian money market ensures that participants have access to funds when required and facilitates efficient utilization of resources.

B. Monetary Policy Transmission:

The Indian money market acts as a crucial means for the transmission of monetary policy decisions made by the RBI. The central bank changes in the repo rate, reverse repo rate, and other policy instruments that influence interest rates and credit availability throughout the economy. Thus the economy functions in a smooth way.

C. Funding Source for Corporates:

Corporates regularly require short term funds for running their businesses.They rely heavily on the money market to raise short-term funds to meet their working capital requirements. The issuance of Commercial Papers and Certificate of Deposites provides them with a cost-effective and convenient source of financing.

D. Role in the Government’s Borrowing Program:

Just like business entities the government also requires funds to finance their developmental expenditures and social welfare schemes and also to bridge fiscal deficits. For this the government issues Treasury Bills in the money market. The Indian money market ensures the government’s borrowing needs are met smoothly.

E. Economic Stability:

The efficient functioning of the Indian money market ensures overall financial stability in the economy. Through money market instruments – effective resource allocation is promoted, speculative activities are curbed and steady flow of funds is ensured.

F. Role In Managing Systemic Risks:

During times of financial crises, the Indian money market plays a critical role in managing systemic risks. The Indian money market provides liquidity to the financial institutions and corporates and helps prevent liquidity crunches and promotes financial stability. Liquidity crises are avoided the RBI’s intervention through open market operations and liquidity infusion measures.

G. Integration with Financial Markets:

The Indian money market is interconnected with other segments of the financial market, including the capital market, foreign exchange market, and the banking system. Developments and fluctuations in one segment can impact the functioning of others, making coordination and policy coherence essential to ensure overall financial stability.

Challenges and Future Outlook For Indian Money Market

Despite its phenomenal significance in the Indian Economy, the Indian money market face a lot of challenges.These challenges need to be addressed to enhance its efficiency and effectiveness. Some of these challenges can be seen as::

A. Lack of Depth:

The Indian money market lacks depth as it is heavily reliant on a few participants, limiting its overall capacity and functioning. The volumes may further increase if the participation is increased.

B. Interest Rate Volatility:

Being a developing economy, the interest rates keep on fluctuating. These interest rate fluctuations in the Indian money market can impact the cost of borrowing and influence investment decisions in the economy which may in turn lead to slow down.

C. Regulatory Framework:

The regulatory environment at times hampers the very purpose that the money market is meant for. Thus the regulatory framework requires constant monitoring and updating to adapt to changing market dynamics and emerging risks. It should also be geared up for international influences on the Indian economy.

Recent Developments and Reforms In The Indian Money Market

In order to enhance its efficiency, transparency, and depth, in recent years, the Indian money market has witnessed significant developments and reforms. For this new money market instruments are introduced and new technologies have been adopted. These can be seen as:

A. Introduction of Commercial Paper (CP) Repository:

The RBI introduced the Centralized Payment Systems (CPS) for CPs, in order to increase transparency and streamlining CP issuance. This repository allows issuers and investors to electronically register, store, and view details of CP issuances. It provides real-time data and reduces the operational burden associated with physical issuance and handling of CPs.

B. Tri-Party Repo:

The Tri-Party Repo mechanism allows for better collateral management and reduces counterparty risks. It involves a third-party agent, acting as a facilitator between the borrower and the lender, thus improving operational efficiency.

C. Money Market Mutual Funds (MMMFs):

In the money market, only big players are allowed to participate and the retail investors were left out. The introduction of MMMFs allows retail investors to participate indirectly in the money market. These funds invest in money market instruments on behalf of investors, providing them with an opportunity to earn competitive returns with relatively low risk.

D. Liberalization of Foreign Portfolio Investment:

The mechanism of liberalization of foreign portfolio investment in the Indian money market has attracted foreign institutional investors (FIIs), increasing the depth and liquidity of the market. In the era of globalization, this move also strengthens India’s integration with global financial markets.

The Way Forward For Indian Money Markets

Indian Money markets have come a long way in the past 100 years. With a few modifications they can function in a more healthy manner ensuring stability along with economic growth.

- Enhancing Market Depth: To attract more participants and enhance market depth, efforts must be made to develop a broader range of money market instruments and promote their wider use.

- Addressing Liquidity Mismatches: The money market needs to manage the inherent liquidity mismatches that arise when short-term funding is used to finance long-term assets. Adequate liquidity management tools and risk mitigation strategies are required to handle these challenges effectively.

- Strengthening Regulation: Regulatory oversight needs to be strengthened to prevent potential risks and malpractices. Regular updates to the regulatory framework and close monitoring of market participants are crucial to maintain market integrity.

- Promoting Financial Inclusion: Efforts should be made to bring more participants, especially in rural areas, into the formal money market to reduce dependence on informal sources and promote financial inclusion.

- Embracing Technology: Leveraging technology can significantly enhance the efficiency and transparency of the money market. The adoption of fintech solutions, such as electronic trading platforms and digital settlement systems, can improve liquidity and reduce operational inefficiencies.

Conclusion

The Indian money market is instrumental in fostering financial stability, facilitating liquidity management, and promoting economic growth. Through its organized and unorganized segments it caters the needs of a wide variety of participants. The Reserve Bank of India ensures the smooth functioning of the Indian money market by providing a regulatory framework. India has become the 5th largest economy of the world. All the components of the Indian money market help in the country’s economic growth. In this journey the Indian money markets have played a pivotal role. It will continue to do so in order to sustain the progress of the country along with its economic growth.

Indian Money Market UPSC

From UPSC CSE point of view, a deeper understanding of the Indian money markets is very essential. The knowledge of the Indian money market would give better insights into a comprehensive understanding of the Indian economy and all other related aspects. It is an important topic from the Prelims as well as mains point of view.

Read Also

FAQs On Indian Money Market

What are the functions of Indian money market?

The Indian money market is an integral part of the entire financial ecosystem. Its main functions are: liquidity management, trade financing, risk mitigation, financing the government, facilitating short term borrowings etc

What do you mean by money market?

Money market is that segment of Indian economy that is instrumental in short term funds. There are various instruments through which the Indian money market operates like: Call money, Commercial Paper, Treasury Bills, Certificate of Deposits etc. The money market ensures that the corporate and government entities do not face bottlenecks in the form of money.